S&P 500 2752,06 -36,8.

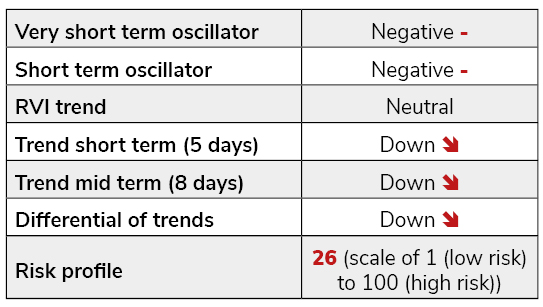

The political agenda is still dictating the course of the market with an increase of the rethoric on the two sides of the pacific ocean. The stock market couldn’t hold the 2800 support area and fell sharply testing the 2750 zone which acted during the whole year 2018 as a pivot point. Anxiety and fear are back into the market after some complacency we observed at the beginning of the spring. Hedging activity is intense in the option market and the psychology of various market participants has turned sour, as measured in various weekly surveys. It is interesting to note that the closing tick index held very well during the decline and closed most of the days on the positive side, indicating that money is flowing in during the last minutes of trading. The last sentence of our previous comment written on the 24th of May is still of actuality: «In this context of a globally oversold market and with a low and erratic visibility on the political front, the systematic models have their use and should be followed to avoid being an hero trying to catch a falling knife. It is wise to wait for a turn of our model and others used by market participants confirming a change of the trend before entering into the market. This may happen at any time or delayed but at least the model presents a constructive configuration with a fairly low risk’s appraisal».