S&P 500 2822,24 -34,03.

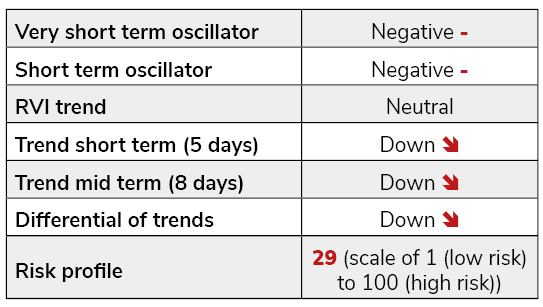

Finally, the scenario of a retest of the 2800 area took place and the stock market rebounded slightly at the end of the trading session after a sharp initial selloff. Hedging activity in the options market was intense and our daily sentiment measures improved markedly. Some of our indicators have entered into the green zone whereas others still have some room to improve. In this context of a globally oversold market and with a low and erratic visibility on the political front, the systematic models have their use and should be followed to avoid being an hero trying to catch a falling knife. It is wise to wait for a turn of our model and others used by market participants confirming a change of the trend before entering into the market. This may happen at any time or delayed but at least the model presents a constructive configuration with a fairly low risk’s appraisal.

Next update Monday 3rd June 2019.