S&P 500 3097,74 -17,60.

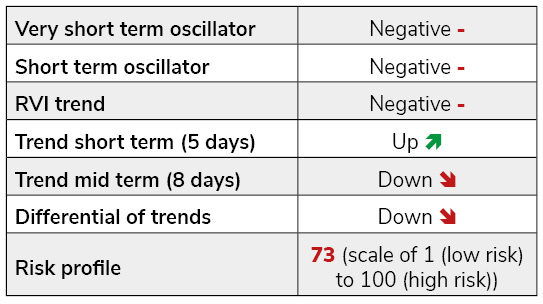

The quarterly expiration of options and futures brought expected intra day volatility : after a strong opening, the stock market drifted lower to close almost on the lows of the trading session on heavy volume and renewed selling pressure, as measured by our buying/selling index and the closing tick index. Breadth closed negative: 1433 stocks advanced on the NYSE compared to 2444 that setlled down. Options traders were still eager to buy calls but on a lower proportion than during the last few days. Most systematic models are still pointing down despite last week’s rally. Short term market participants like hedge funds are going to position themselves for the third quarter and it will be interesting to watch closely how they handle it over the next few days.