S&P 500 3234,85 -23.

We wish our readers a happy and prosperous year 2020.

We observed during the last trading days of 2019 a kind of panic buying among market participants who missed last year's bull market, the opposite behaviour of December 2018.

We publish again our first comment of 2019 which correctly and early in the cycle anticipated the bull market:

2018 has been a challenging year in the markets with swift, hectic and volatile up and downmoves. Our methodic and cautious approach bore fruit as our trading account based on «Market pulse» yielded a 12% return net of fees.

The Christmas period didn't let investors and traders enjoying their holidays as volatility hit its peak of the year. Finally, we observed the 21st and the 24th of December signs of capitulation, as measured by our fear/greed index and our capitulation index. Our global risk index reached the low 20's, a reading usually associated with bottoms. There is a good chance that the bulk of the downfall is behind us and that the market has reached a bottom. We mentionned several times during the fall the importance we attach to the internal momentum and recently the global advance/decline line has shown signs of revival. Sentiment indicators are also positive as there is a great deal of skepticism among various market participants. The market may be in a position to climb back a wall of worry, a good sign.

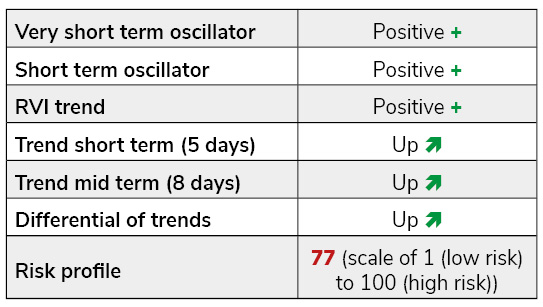

Although internal momentum has been very strong lately, the risk profile index deteriorated sharply to a level reflecting an elevated risk. The market may be poised to a correction/consolidation period which would be more than welcome to reset our indicators to a more favorable level. The sentiment indicators are pointing out to a level of excessive optimism and complacency. The recent geopolitical situation may cool somehow the greedy attitude of some market participants and bring some cautiousnees and even fear. This would be healthy for the sustainability of this bull market.

Our trading account based on «Market pulse» yielded a 25% return net of fees in 2019, which stands above our objective of generating a 15% annual return in any market's situation. Over the last five years, this long term objective has been reached.