S&P 500 2581 -100,66.

The stock market didn’t spend much time stabilizing before selling pressure resumed. The hot money that entered late in stocks is rushing out and derivative traders have to unwind their positions at any cost, some scandals may soon make the headlines ; that has already started with products linked to the Vix. This reminds us October 1987, the easy trade during the year consisted in selling naked puts during the rally, the ensuing carnage has been awful.

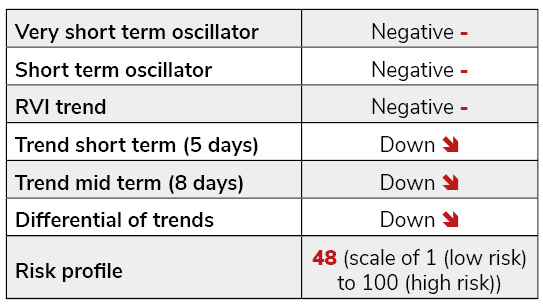

Our indicators are improving but not at the rate of the prices decline, hedging activity in the option market improved but hasn’t reached an extreme yet. 2651 stocks declined compared to only 320 closing up. Our fear/greed index and our capitulation index improved but some indicators still have room. After having spent the month of January in the red zone (above 80), our global risk profile has to reach the low 20’s to wash out definitively the excess speculation. In terms of prices, we can envision an objective around the 2500 level for the S&P 500.